Pay

Orchestrate any payment: pay-in, pay-out, collect, in any currency, for domestic and cross-border.

These four pillars form the heart of finhub.ai. They simplify how businesses move money, manage trust, track cash, and integrate financial systems.

Orchestrate any payment: pay-in, pay-out, collect, in any currency, for domestic and cross-border.

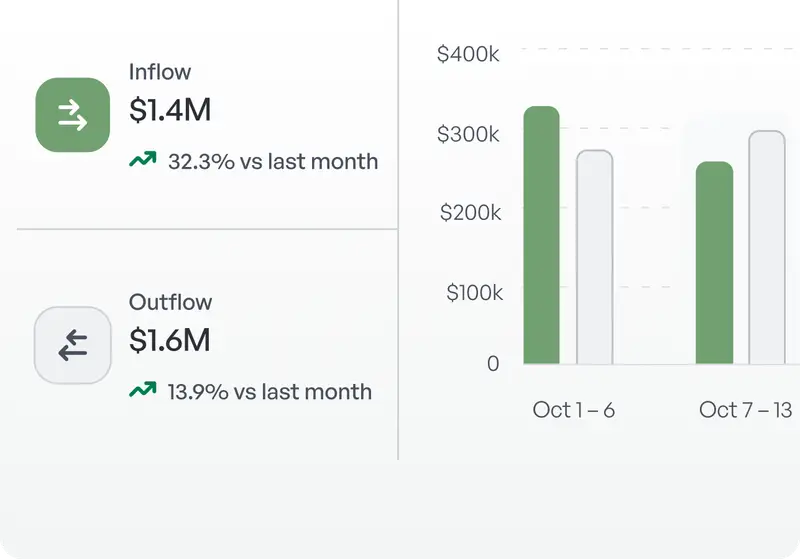

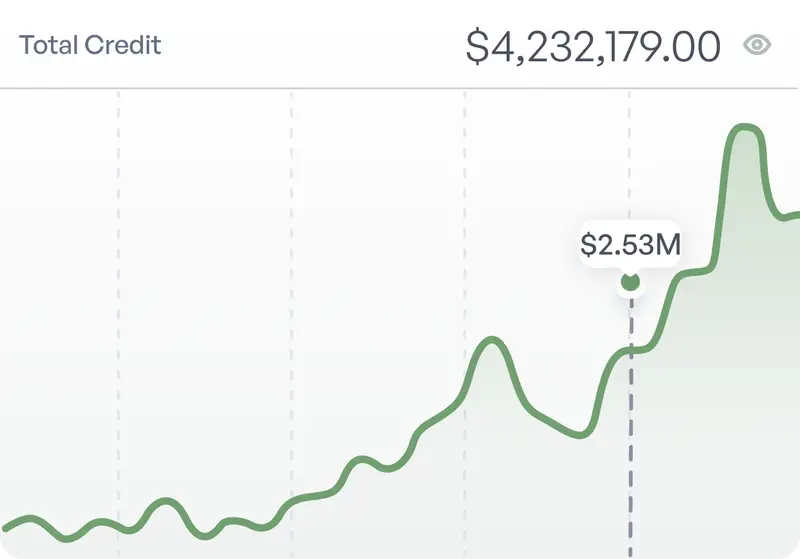

Optimise liquidity management, structure funds across sub-accounts, and gain real-time visibility.

Secure every transaction with flexible trust and escrow mechanisms designed for any business.

Eliminate blind spots and manual errors by integrating financial systems and banking partners.

Real stories of how finhub.ai delivers efficiency, control, and measurable impact across financial operations.

Enabling faster launches, sustainable revenue growth, better compliance and reduced operational risk

Go live quickly with configurable payment flows and minimal integration effort

Create and scale new monetization models in hours with minimal setup

Operate confidently with controls designed to meet institutional and regulatory requirements

Minimize operational and financial exposure with embedded trust and institutional controls

Powering regulated institutions, large-scale operators, and fast-growing platforms worldwide

Accelerate growth by offering escrow, trust, payout, and liquidity products across regions — with frictionless onboarding and end-to-end automation that redefine speed and versatility in transaction banking.

Modernize finance operations, streamline payments, automate reconciliation, and gain full control over cash accounts — all within a single, easy-to-use platform.

Automate every payment workflow, reconcile in real-time and optimize liquidity - all on a platform built for speed, scale and flexibility.

Share your current workflows or challenges and our team will walk you through how finhub.ai can improve your financial operations.